No matter how sunny the Golden State is, California employees may be feeling an ominous chill when looking at their take-home pay lately. Yes, the cold hand of the tax man arrived in, with changes to the CA SDI contribution rate and the removal of the taxable wage ceiling. These changes have come into full effect in 2025 with yet another increase to the contribution rate — leaving employees asking “Why the heck am I being taxed so much for something called SDI this year???”

In this article, we’ll help you answer the above, as well as the rest of your employees’ biggest SDI questions. We’ll dive into the true costs of changes to the SDI, and show you how Voluntary Plans can help protect your employees from increased costs while delivering larger payouts, and faster claims processing. We’ll also show how Voluntary Plans can be a big win-win for employees looking for a better experience and organizations looking to generate a potential surplus. Let’s dive in.

What is CASDI

California State Disability Insurance (CASDI) is a state-mandated program designed to provide short-term disability benefits to eligible employees who are unable to work due to a non-work-related illness, injury, or pregnancy. SDI also provides Paid Family Leave (PFL) benefits for those who need to care for a seriously ill family member, bond with a new child, or participate in a qualifying military event.

Originally established to provide a reliable safety net, CA SDI requires employees to contribute a percentage of their wages toward coverage. These contributions fund payouts to employees who qualify, allowing them to receive a portion of their wages for up to 52 weeks, depending on their medical condition or up to 8 weeks for PFL.

In theory, CASDI provides a net social good, by ensuring that workers have stable financial support when they need it most. However, the program’s recent changes have raised concerns about affordability for some employees, particularly high-earners.

Understanding how CASDI functions and what benefits employees can expect is crucial in managing their financial well-being. With rising contribution rates and the elimination of the wage ceiling, employees are seeking clarity on their options and alternatives to mitigate the impact of these changes.

What are the latest changes to the CA SDI?

So what exactly are these changes, and why are your top earners taking home less? Legislation passed in 2022 regarding California’s SDI program came into effect in 2024, fundamentally altering the financial landscape for employees. The most impactful changes include:

No more taxable wage ceiling

Previously, employees’ contributions were capped at an annual wage limit (per a formula in the California Unemployment Insurance Code) – in 2023, the wage limit was $153,164. However, as of 2024, that cap has been eliminated. This means that all wages are now subject to the SDI tax, creating a significant financial burden for high-income earners.

Higher contribution rates

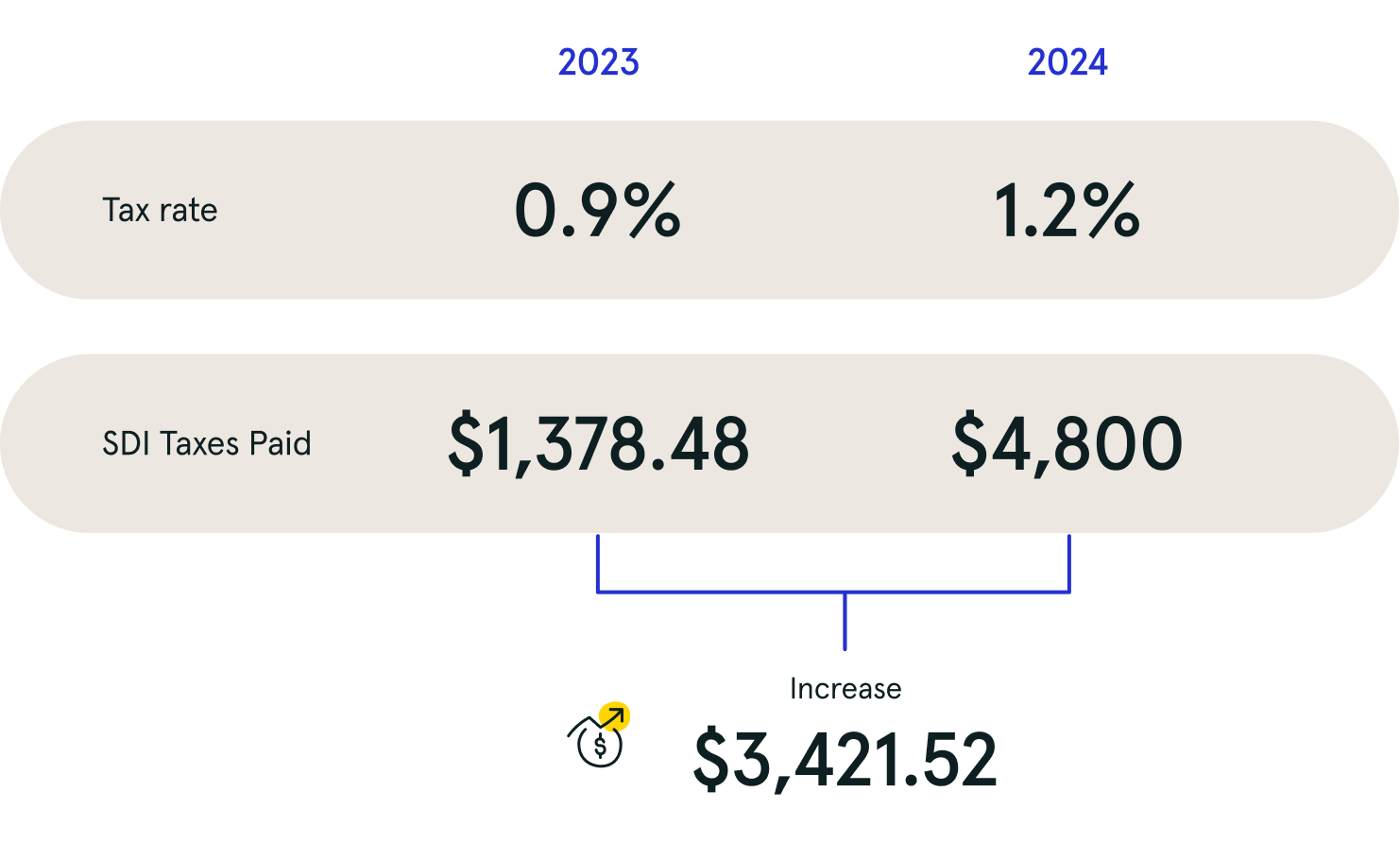

The payroll tax rate has increased from 0.9% in 2023 to 1.1% in 2024 and now 1.2% in 2025, further cutting into employees’ paychecks. For those who earn higher salaries, this could result in thousands of dollars in additional payroll deductions each year.

The combination of these two changes is adding up to a bigger tax bill and frustrated employees. Employers must now navigate how to address these concerns with their workforce while ensuring compliance with state regulations, but understanding the real cost of the SDI is crucial when formulating an effective leave and benefits strategy. So..

…How much will the CASDI cost my employees?

Let’s break it down:

In 2023, an employee earning $400,000 paid $1,378.48 in SDI taxes at a 0.9% rate. In 2024, with the new 1.2% tax rate and no wage ceiling, that same employee will pay $4,800—an increase of $3,421.52 in additional taxes.

It’s important to note that though the increased costs caused by changes to SDI heavily impact high-wage employees, mid and low-earners will face minimal changes in their take-home pay. For organizations primarily composed of the latter, SDI may remain the most cost-effective and safest approach for employees.

That being said, many workers may have gripes with CASDI beyond financial costs. After all, no matter the wage, all of us only have so many hours in the day, and the experience of dealing with the notoriously gridlocked California Employment Development Department (EDD) can be time-consuming and frustrating.

The EDD receives millions of calls annually, yet answers fewer than 6% of them, leading to delays, confusion, and dissatisfaction. Employees have reported difficulty receiving timely payments, which in the case of PFL are only issued via checks or separate ATM cards, adding another layer of inconvenience. For employees already experiencing a health crisis, these administrative hurdles can add unnecessary stress.

What is a Voluntary Plan?

A Voluntary Plan (VP) is an employer-sponsored alternative to California’s SDI program that provides the same or better benefits while giving employers and employees greater flexibility and cost control. Instead of sending contributions to the state, employers hold the funds in trust and administer claims directly or through a third-party administrator (TPA).

Under a Voluntary Plan employers can tailor their plans, offering customized benefits that align with the company’s goals and employees values. Additionally, Voluntary Plans provide more transparency, allowing employers and employees to track funds, assess claims processing efficiency, and make informed adjustments to the plan structure.

To be eligible, a VP must:

- Offer benefits equal to or better than CASDI

- Not cost employees more than the state program

- Be approved by the majority of eligible employees

How do Voluntary Plans benefit employees?

For employees, a VP offers several advantages that enhance their financial well-being and overall experience:

Lower deductions

Lower deductions

Voluntary Plans allow employers to set lower contribution rates than the SDI, meaning employees take home more of their paycheck.

Maintained wage cap

Maintained wage cap

Unlike SDI, Voluntary Plans allow for wage caps, protecting high earners from excessive taxation.

Higher benefit payouts

Higher benefit payouts

In one case study where Larkin administered an organization’s Voluntary Plan the organization was able to increase weekly benefits to $3,000, compared to the state’s $1,681.

Faster claims processing

Faster claims processing

Unlike the CA SDI where all claims must go through the EDD, under a Voluntary Plan claims can be processed directly through the employer or a third-party administrator, allowing employees to dodge bureaucratic traffic jams.

Personalized support

Personalized support

Employees receive dedicated assistance, making it easier to navigate the claims process during critical times.

Flexible payout options

Flexible payout options

Employees can receive funds from their employer via their regular payroll process, as well as through direct deposit or other preferred methods, reducing delays.

How do Voluntary Plans benefit organizations?

Depending on the organization’s makeup and the anticipated percentage of payouts, a Voluntary Plan can be a leave-and-benefit win-win, granting major gains to employees and employers alike. Employers who adopt Voluntary Plans may enjoy:

A surplus that can be re-invested into greater employee well-being

Employers can accumulate surplus funds if contributions exceed claims, which can then be used to increase the weekly benefit, decrease the contribution rate, remove waiting periods, increase the duration for PFL, or otherwise be used to benefit participants in the Voluntary Plan.

Greater control and flexibility

Voluntary Plans allow employers to design their benefits package to align with business goals, rather than being confined to the state’s one-size-fits-all approach. This greater degree of control helps HR leaders ensure that their leave programs serve their EVP (Employee Value Proposition), which Gartner has cited as a major factor when it comes to retention, showing that companies that can make good on their EVP can reduce turnover by as much as 69%. Speaking of which…

Stronger employee engagement and retention

Providing enhanced benefits through a Voluntary Plan, while promising greater take-home pay can serve as a powerful recruitment and retention tool in competitive talent markets, particularly for top employees.

All of the above benefits may sound pretty tantalizing, but it’s important to fully assess whether your organization is a good fit for a VP before integrating one into your leave and benefit strategy. Luckily, Larkin has a set and easy process for determining fit, including offering a feasibility study that can take the guesswork out of Voluntary Plans.

California’s SDI changes have put employees and employers in a tough spot. With higher contributions and removal of the wage cap, Voluntary Plans can offer a proactive solution that provides better benefits, cost savings, and a superior experience for many organizations and employees.

Larkin makes transitioning to a Voluntary Plan simple by managing every step—from employee approvals to regulatory filings—so you can focus on leading your organization’s HR strategy rather than being bogged down in administration. With over 20 years of experience, we can help you unlock the full potential of a Voluntary Plan for your organization.

Ready to learn more?

Watch our webinar to explore how Voluntary Plans can work for your organization.