U.S. Federal Updates

President Biden’s Executive Order requiring federal contractors and subcontractors with a covered contract to be vaccinated against COVID-19 has essentially been suspended. The U.S. District Court for the Southern District of Georgia has issued an order granting a preliminary injunction that blocks enforcement of the Executive Order nationwide. You may want to continue to prepare for the mandate if it happens to move forward in the future.

The Centers of Medicare and Medicaid Services (CMS) vaccine mandate for healthcare workers has also been suspended nationwide per an injunction issued by a Louisiana federal judge.

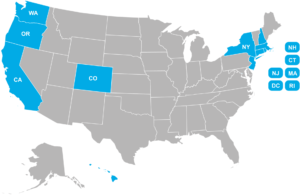

U.S. State Updates

California

California Family Rights Act (CFRA)

Quick reminder that employees will be able to take leave to care for a parent-in-law with a serious health condition starting January 1, 2022. “Parent-in-law” is defined as the parent of a spouse or domestic partner. This change should be reflected in your leave policy and/or employee handbook.

Employment Development Department (EDD)

The EDD has recently been inundated with fraudulent State Disability Insurance (SDI) claims from individuals looking to defraud the state. It appears bad actors out there have moved from Unemployment Insurance to Disability Insurance. The EDD is actively working on measures to address the situation. In the meantime, you may be familiar with form DE 2503 – this is the form the EDD sends when an employee files a claim for disability benefits. The EDD has confirmed that the DE 2503 needs to be completed even if the individual listed on the form is not an employee of your company.

If the individual has never worked for your company, you will need to check the appropriate box in section #2 and then complete your information in sections #9 and #10. If the individual listed on the form is an active employee who has not filed a claim (we recommend confirming with the employee), then employers should write anywhere on the form that the “Employee did not file a claim” and complete the employer information in sections #9 and #10. More information regarding fraud (including options for reporting fraud) may be found here on the EDD’s website.

San Francisco – Office of Labor Standards Enforcement (OLSE)

The OLSE will release the 2022 Paid Parental Leave Ordinance (PPLO) wage cap in January. Based on the calculation found in Article 33H, Section H.4 of the San Francisco Police Code, we are anticipating the cap to increase from $2,262 to $2,567. The amount of supplemental compensation is calculated by dividing the state’s maximum weekly benefit amount ($1,540 as of January 1, 2022) by the benefit percentage (60%) provided under California Paid Family Leave. We will let you know when the OLSE releases the final cap amount.

Connecticut

As you know, benefits under the CT Paid Leave program will be available as of January 1, 2022. Employees can actually start filing claims now. Employers are an integral part of the claims process. Here are some important details regarding the process:

- Employees need to create an account at org. They can also apply by calling Aflac’s Claim Center or by faxing, emailing, or mailing their application (specifics may be found here). You may want to share the program’s tutorial video with your CT employees which provides the step-by-step process for creating an account.

- Employers will need to complete the Employer Verification Form provided by the employee and then submit it to Aflac within 10 days of receipt.

- A claim decision will be made within 5 business days of receipt of all completed information. Decisions will be communicated to employees based on their preference (e.g., telephone call, email, letter, portal).

- Benefits are issued via direct deposit or with a Visa debit card

While the official notice to provide to employees is not yet available and is not required until July 1, 2022, we suggest providing your employees (and those hired January 1st or later) with this poster so that they are aware of the program.

Hawaii

The Aloha State has released changes to its Temporary Disability Insurance (TDI) program for 2022:

- The maximum weekly benefit will increase from $640 to $697

- The weekly taxable wage ceiling will increase from $1,102.90 to $1,200.30

- The weekly cap for employee contribution will increase from $5.51 to $6.00

More details can be found here.

Louisiana

You may recall from this summer’s newsletter that the Pelican State amended its pregnancy discrimination law. The law went into effect August 1, 2021 and requires Louisiana employers who employ more than 25 employees to make reasonable accommodations for pregnancy, childbirth, or pregnancy-related conditions (barring undue hardship). The required notice is now available here. Notice must be provided to new employees upon hire and to existing employees. It also needs to be conspicuously posted at an employer’s place of business in an area that is accessible to employees.

We want to point out to you an important part of this law. It will be considered unlawful for an employer to refuse to allow a female employee affected by pregnancy, childbirth, or related medical conditions to take leave for a reasonable period of time. “Reasonable period of time” means six weeks for a normal pregnancy and childbirth or the period of time during which the female employee is disabled on account of the pregnancy, childbirth, or related medical conditions, provided the period does not exceed four months. The Larkin Company will administer pregnancy disability leaves under this law.

Minnesota

Quick reminder that SB 9 goes into effect January 1, 2022. The law requires that employers with 15 or more employees provide reasonable accommodation to an employee for conditions related to pregnancy or childbirth, barring undue hardship. For further details, please refer to this newsletter.

New York and New York City

The Empire State and the Big Apple are not deterred by the suspensions of the various federal COVID-19 vaccine mandates as they move full speed ahead in combating a possible winter surge of COVID as well as the omicron variant. Governor Hochul announced on December 10, 2021that starting on Monday, December 13th, masks will be required to be worn in all indoor public places unless businesses or venues implement a vaccine requirement. Employers can implement a vaccine mandate for employees and customers in order to enter the business. The mandate will remain in effect through January 15, 2022. The state has provided some FAQs regarding the new requirement.

Earlier this week, New York City Mayor Bill De Blasio announced a vaccine mandate (in order to work in person) for all private-sector employees that takes effect on December 27th (employees must have received at least one dose of COVID-19 vaccine). Employees will be able to request reasonable accommodation but there will not be a testing alternative.

Further, the New York City Council passed a bill on November 23, 2021 that will entitle an employee, who is a parent or legal guardian of a child, to four hours of leave per vaccine injection for each of their children. The leave may also be used to care for their child due to side effects from the vaccine. This leave is in addition to the employee’s accrual or use of existing safe/sick time. Employers may require reasonable notice (no more than seven days) and also require (within seven days) that the employee provide documentation that their child was vaccinated. The bill awaits the Mayor’s signature and will expire on December 31, 2022.

Oregon

Another quick reminder that beginning January 1, 2022, employees in Oregon will be able to utilize leave under the Oregon Family Leave Act (OFLA) if they need to care for a child whose school or care provider has closed due to a public health emergency (e.g. COVID-19). See this newsletter for more details.

Rhode Island

Yet another quick reminder that the duration for Temporary Caregiver Insurance effective January 1, 2022 is increasing from 4 weeks to 5 weeks.

Washington

The Employment Security Department (ESD) has released the updated mandatory employer poster and paycheck insert for 2022. The paycheck insert is optional. The ESD provides helpful guides for employees that you may wish to share. The benefit guide was updated last month while the family and parent guides were updated in August.

Canada Federal Update

Employment Insurance (EI) Federal Benefits

Effective January 1, 2022, the maximum insurable earnings (MIE) for EI benefits increases from $56,300 to $60,300. This is the maximum income level up to which EI premiums are paid. The employee premium rate will be $1.58 per $100 in 2022. Considering the updated MIE and premium rate, insured workers in 2022 will be subject to a maximum annual EI premium of $952.74 (compared with $889.54 in 2021).

Due to the increased MIE income level, the maximum weekly EI benefit rate will increase from $585 per week in 2021 to $638 per week for EI claims that start in 2022. Note: the extended plan benefits for parental leave are expected to increase from $357 per week in 2021, to $383 per week in 2022.

Canada Provincial Updates

British Columbia

While we don’t administer sick leave, we want to make you aware that employees in British Columbia will be entitled to a minimum of five paid sick days each year starting January 1, 2022. This applies to employees covered by the Employment Standards Act (ESA), including part-time, temporary and casual employees. This entitlement is in addition to the 3 days of unpaid sick leave currently provided by the ESA. Employees must have worked for their employer for at least 90 days to be eligible for the paid sick days. Employers may request reasonably sufficient proof of illness.

Quebec Parental Benefits (QPIP)

If you are curious about QPIP benefit rates for Quebec employees for 2022 – these are pending and we hope the government will release the confirmed rates soon. When they do, we will confirm these via newsletter.