As an employer, you recognize that most employees are caregivers—in fact, 73% of them. Among these, 60% report that their responsibilities impact their productivity or ability to return to work, and the number of employees caring for an older adult is expected to double in the coming years.

Offering robust support to these employees isn’t just beneficial for their well-being or their ability to be fully present at work; it’s crucial for attracting and retaining top talent. So, how can you provide more than the bare minimum in a way that’s both incentivizing and financially viable? A Voluntary Plan (VP) could be the solution and now might be the perfect time to consider one.

What is a VP, and how does State Disability Insurance (SDI) measure up?

Companies in California are mandated to offer disability insurance and can either stick with the state-provided program (SDI) or opt for a Voluntary Plan (VP), which is a private, self-insured program. This year, California raised the tax rate and removed the wage ceiling for SDI deductions, resulting in higher contributions from employees, particularly affecting high earners.

The Employment Development Department (EDD) has confirmed that there is no need to integrate the wage ceiling with SDI payments for Voluntary Plans, allowing employers to implement a VP at any time with immediate contributions. These tax changes create an opportunity to design a customized plan that offers employees more benefits without additional costs to you.

Benefits and Contributions

VP requirements stipulate that an employer may deduct the same amount or less from its employees’ paychecks as the SDI. If claims are infrequent within their workforce, the saved funds can be utilized to enhance benefits or to reduce—or even waive—contributions. In our case study, we demonstrate how a large Larkin client in Silicon Valley was able to offer nearly double the weekly benefits of the SDI and drop their contribution rate to 0.65% versus the state’s 1.1%.

Claims and Payments

The SDI requires employees to file their claims with the Employment Development Department (EDD), which can be a lengthy, uncomfortable process. Their high volume of claims makes it hard to reach a representative or ask any questions, and employees can only receive payments by check or separate ATM card, which are often delayed. In contrast, with a Larkin-managed Voluntary Plan, employees can file their leave and claims through a dedicated administrator and receive payments through regular payroll channels. Learn more about how we streamline processes in this on-demand webinar.

Savings and Surplus

As outlined earlier, the mechanics of a Voluntary Plan can result in the accumulation of surplus funds if claim frequencies are low and contributions exceed payouts. These savings can be significant, benefiting both employees and employers. For example, our client saved $30 million over the first ten years of their VP. This plan not only covered all program costs—including administrative expenses, assessments, security measures, taxes paid to the EDD, and the claims themselves—but also resulted in a $6 million surplus. The company reinvested this surplus into enhancing employee benefits, including additional savings or direct refunds, higher benefit levels, and new benefit options at no extra cost.

Additional Support

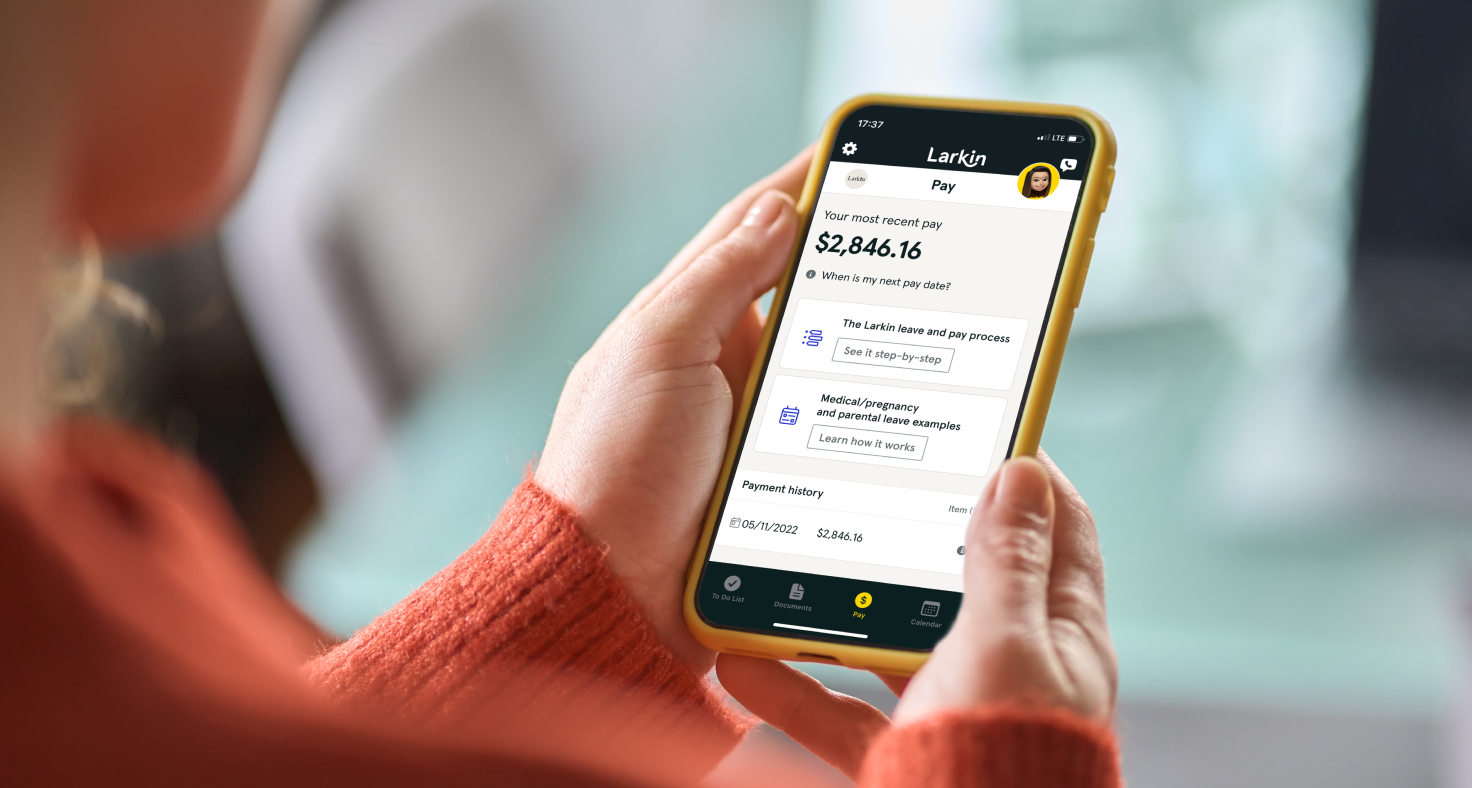

Not only does the SDI deduct more and pay less, but the state program also fails to address the caregiving commitments that often necessitate taking leave and claiming benefits in the first place. With a Larkin-managed Voluntary Plan, employees gain access to the Family Care Concierge, which offers a variety of support methods including digital (via our Digital Care Advisor app), in-person, and direct assistance. The app uses AI to help employees locate child or elder care options and the financial programs available to cover these costs. It allows employees to ask questions and receive a customized action plan, which includes form links, checklists, cost comparisons, and practical tips. This comprehensive support can even make taking a leave of absence unnecessary. We are the only leave administrators to offer a service like the Family Care Concierge. Thanks to this unique offering, our client experienced a 476% return on investment, as employees were able to spend significantly less time away from work.

What does the process of setting up a VP look like?

A Voluntary Plan may not be right for all employers, as it poses financial risks not associated with the SDI. Under the state program, the employer isn’t responsible for expenses that exceed employee contributions; the SDI absorbs these costs. In contrast, with a VP, the employer must cover any additional costs, either by using surplus funds from previous years to cover deficits or by essentially lending money to the plan. Although the SDI’s contribution rates are high enough to keep risk low, risk still exists.

However, this is where Larkin’s 40 years of experience in setting up and administering Voluntary Plans comes into play, significantly mitigating that risk. We possess the expertise and experience necessary to determine if a VP is the right fit for you and provide the guidance and support needed to ensure its success.

Feasibility studies

We would never implement a VP for a client without first assessing the risks and generating a forecast. Larkin will examine employee demographics, wages, and leave activity to create an accurate picture of expected claims activity. We then use conservative predictive modeling to calculate the plan’s income and expenses and provide recommendations on plan design that will both benefit employees and ensure long-term financial stability. Employers get a clear view of the numbers involved, based on data specific to their organization and workforce. Request your feasibility study today, and remove the guesswork from considerations of a Voluntary Plan.

Facilitating implementation

Transitioning from SDI to a tailored Voluntary Plan can be daunting. We understand the intricacies of operational and financial systems, and collaborate with you to customize the claims process. Our approach includes streamlining communications, enhancing the employee journey, integrating payments, and ensuring a seamless transition. We are committed to smooth implementation from start to finish, making the switch as straightforward as possible.

Strategic monitoring

Once a plan goes live, we have a team of dedicated analysts who monitor and review the plan’s financial health at regular intervals. We meet with our clients at least once a year to provide updates on the VP’s financial status and to offer recommendations for future financial success. If your plan generates a surplus, Larkin will provide the knowledge and guidance necessary to utilize those funds effectively for the best possible outcomes. Learn more about our process and analysis in our webinar.

Become the best employer you can be, at no extra cost

Larkin has been pioneering the design, implementation, and management of Voluntary Plans since the 1980s. With our planning and stewardship, you can design an alternative benefits program that fits both your workforce and your bottom line. A Larkin-managed VP could enhance not only the benefits you offer but also the experience you and your employees have working with us, through our high-touch, empathetic support, frictionless processes, convenient tools, and life-changing solutions. The benefit of a VP isn’t just the edge you gain to attract and retain the best talent in a competitive marketplace; it’s also the ability to better support the wellbeing and productivity of your current team.

Learn more about Voluntary Plans with our on-demand webinar, and read our case study to find out how one client reaped the benefits. Ready to move forward? Get a feasibility study done today, and in two weeks you’ll have a comprehensive view of whether a VP is the right fit for your organization.